Cross-border logistics

Recently, it was widely reported in the media that InPost had opened up to foreign shipments. We will have to wait a while for the first results of this movement, but it seems that supporting cross-border e-commerce is a well-thought-out decision, and the question about its success is not a question of "if", but of "when".

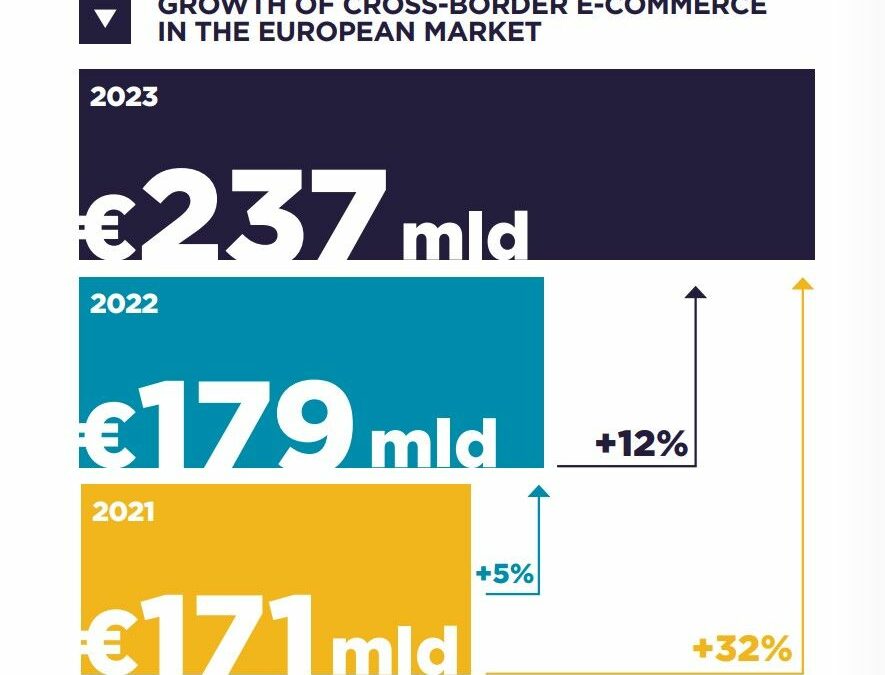

According to the report "Quo vadis E-commerce 2024?" by Cushman & Wakefield, „Last year, European cross-border e-commerce volume reached €237 billion, up 32% year-on-year. By 2028, the global market is likely to be worth €3.1 trillion, with 33% of transactions being cross-border. This raises the question of what is needed for Poland to become a key center of this growing trend.”

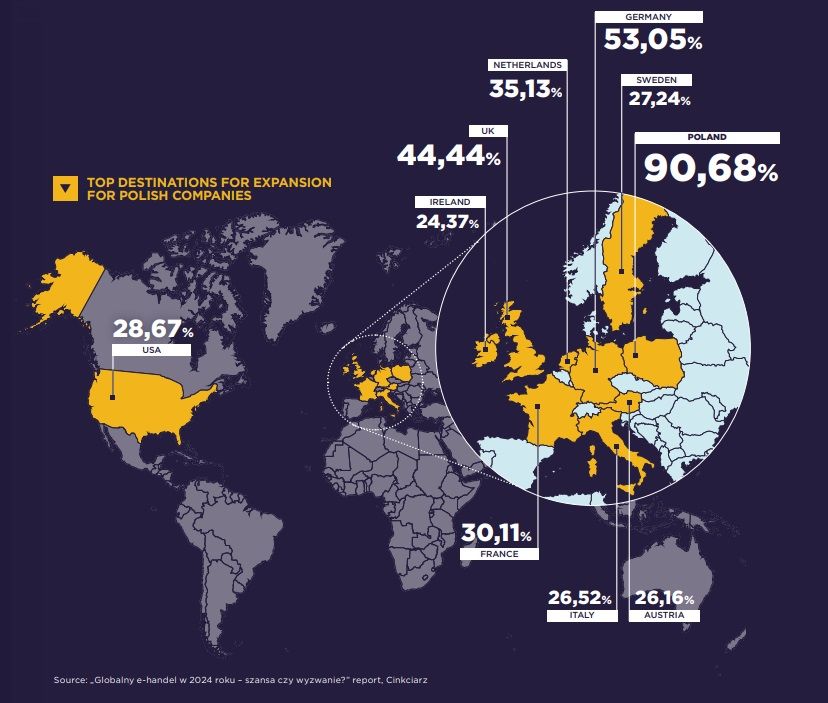

Especially since, according to Eurostat data, only 5% of Polish companies sell online in other EU markets, which puts Poland in third place from the bottom, while the countries at the top of the ranking have double-digit indicators: Austria - 15%, Belgium, the Netherlands, Slovenia - 12% each ("Quo vadis E-commerce 2024?", Cushman & Wakefield).

What is perceived as the biggest challenges in cross-border e-commerce in Poland? First of all, high costs of handling returns (36.4% of respondents), high costs of international shipping (27.3%) and warehouse management (27.3%). InPost responds to the first two problems with its new offer. Our algorithms can help with the third one 😁

What does this mean for the logistics industry? Of course, also the shipping peak. And also "of course", this is nothing new, the pattern repeats itself every year - which does not change the fact that it is a challenge that needs to be prepared for. We will watch with interest how the logistics industry will meet customer challenges this year. And speaking of customers - let's be understanding and accept this potentially slightly longer order fulfillment period during this period 🙂

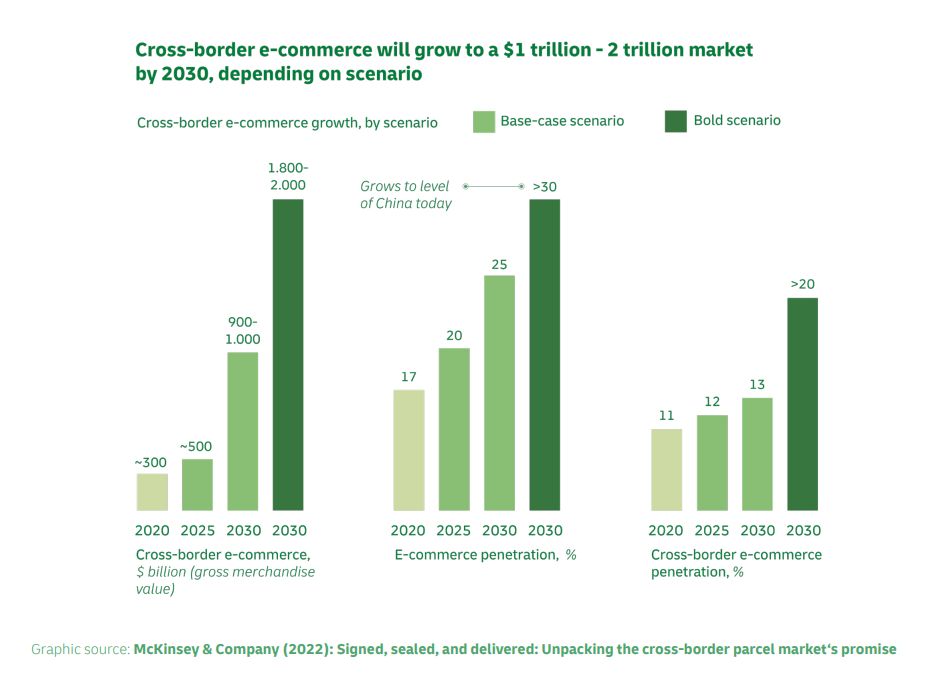

The authors of the "DHL Logistics Trend Radar 7.0” report also draw attention to the growing role of cross-border logistics. According to McKinsey estimates, by 2025 cross-border e-commerce will grow to approximately $500 billion, and by 2030 it will reach $1 trillion. The evolution of e-commerce is largely shaped by the behavior and preferences of Generation Z and Millennial consumers, the development of data and artificial intelligence (AI), and the fact that Chinese e-commerce companies (e.g. Shein, Temu, Tik Tok Shop) are turning their attention abroad. In addition to accelerated global trade, other phenomena driving this trend are social media integration and data crawling (the automated process of systematically exploring the Internet and indexing data sources).